Hitchhiker’s Handbook: A Monthly Voyage Chapter IV

From Wall Street to the Stars: How Tech and Data Are Fueling Our March to a Type I Civilization

Click ▶️ to listen to this blog, but you will miss the graphics and resource links in yellow!

Brief

For my long-form posts, I will write this summary section.

Part I: Echoes of the Past

Peering back into the mists of history, we find ourselves in the midst of the Second Industrial Revolution, a period of immense transformation that saw the world shift from manual labor to mechanization. This age, abuzz with the rhythmic hum of steam and oil machines and shrouded in the smoky traces of industry, laid the groundwork for exponential advancements. Amidst this growth, the birth of the New York Stock Exchange came as a response, establishing a robust financial infrastructure to harness and direct the wealth of a nation on the rise. Let us journey together through this captivating era in our newsletter, as we trace the birth of systems that continue to shape our world today.

The Buttonwood Agreement, as it came to be known, represented the birth of the NYSE. This influential financial behemoth was more than a market; it was the heartbeat of America's economic ambition.

But, what is the essence of wealth? What does currency strive to signify?

We will dive deeper into what true wealth is.

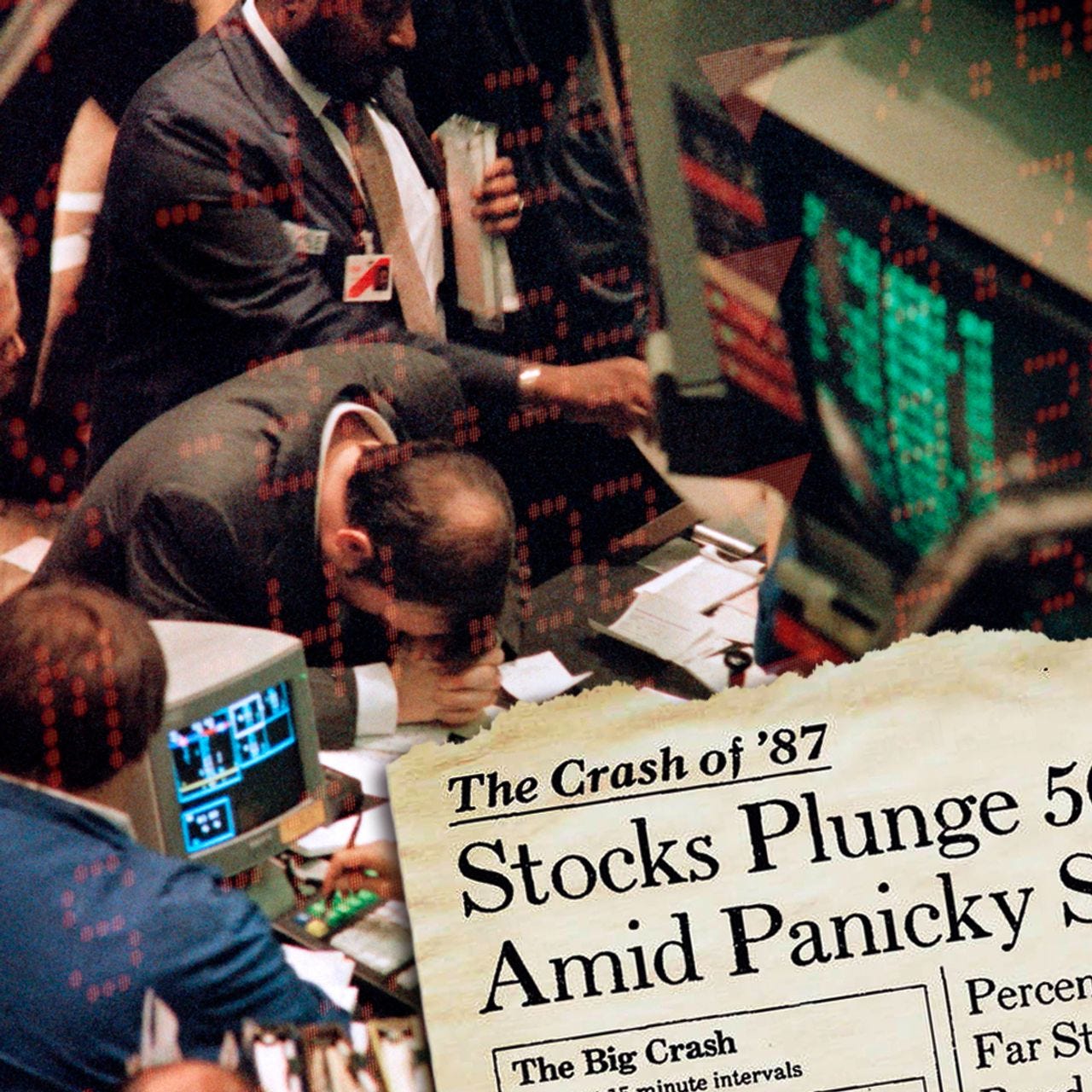

Remember "Black Monday"? The merciless day of October 19, 1987, when markets crashed worldwide, etching the undeniable significance of time in the unforgiving world of finance. This era saw computers making their entrance onto the stock exchange floor, unwittingly inviting a dormant adversary — latency. The cataclysmic events of Black Monday exposed this hidden foe, leading to an extensive overhaul of systems to manage latency and streamline data exchange. The subsequent embrace of the World Wide Web paved the way for the Third Industrial Revolution.

Part II: The Data Gold Rush

Living in the age of high-speed internet and ever-evolving technology, data has emerged as a precious resource. Our zeal for harnessing its power mirrors the enthusiasm of the First and Second Industrial Revolutions. This craving for data has spurred immense investment in advanced broadband systems and powerful computing technologies. Explore more in our newsletter about how fiber optics has ignited a profound data revolution and continues to shape our digital future.

The digital world we have co-created mirrors and magnifies our collective Humanity, forming an immense reservoir of data that's continuously mined for insights. This unending pursuit of knowledge, aided by low-cost computation, is leading us toward becoming a Type I civilization on the Kardashev scale. As we stand on the precipice of this transformative shift, the need for a potent energy source to power our digital journey through this cosmic expanse becomes more evident. Dive into our newsletter to uncover how this digital transformation is unfolding and what it means for our future.

Part III: The Advent of a New Renaissance

The Fifth Revolution, an epoch poised to be sculpted by sustainable energy, artificial intelligence, and the emerging space economy. With a paradigm shift towards renewable energy and digital technology, this transformative era will revolutionize how we generate and consume energy, creating a symbiotic relationship between buildings and power grids, and fostering the rise of intelligent electric vehicles.

Join us as we explore Tesla's "Master Plan", a roadmap towards a sustainable global energy economy that could radically change how we power our world. From the electrification of transport to harnessing the sun's abundant energy, Tesla is pioneering a path of innovation with immense potential. What are the implications of this shift, both environmentally and economically? Get a glimpse into the future of energy with our detailed breakdown.

Discover how Tesla is ushering in a new age of energy trading and management with its groundbreaking Megapack batteries and Autobidder software. Together, they're transforming how we balance and distribute energy, enabling real-time bidding akin to the New York Stock Exchange but for energy. Get a closer look at this exciting development and its potential implications for the future of energy.

Part IV: The Future of Economics

Explore the monumental power of BlackRock's AI, Aladdin, in our newsletter. This intelligent titan is not only revolutionizing finance and reshaping the global economy but also raising critical questions about the role and necessity of human intervention in autonomous systems. Even more intriguing, it has begun integrating sustainability metrics, echoing the world's shift towards sustainable economics. Discover how Aladdin, controlling 7% of the world's wealth, navigates the balance between efficiency and risk, as we contemplate the implications of fully autonomous AI — for better or for worse.

SpaceX's Starlink is aiming to rewrite the rules of global communication in our latest newsletter. Unbound by the limitations of terrestrial technology, this celestial network of satellites could revolutionize data transfer, significantly improving latency over long distances. Learn the science, the potential, and the challenges of this ambitious project, and explore how Starlink could serve as a critical engine for the burgeoning energy economy of the future.

Unveil the exciting journey of humanity's transition towards a Type I civilization in our comprehensive newsletter. With technology and sustainability at the helm, we're navigating through a revolution driven by AI and data. From uncovering our present realities with massive amounts of data to actively shaping our collective destiny, we aim to go beyond passive observation. Dive into our exploration of this new era, and understand how our collective wisdom can guide us towards a future surpassing our past experiences and present limitations.

Part I: Echoes of the Past

1. Where Giants Once Tread: Our Industrial Legacy

Let us journey back to the inception of the Second Industrial Revolution, a period roughly spanning 1870 to 1915. These transformative years marked Humanity's decisive shift from labor-intensive hand production to the rhythmic precision of mechanization. In an era shrouded by the smoky tendrils of industrial activity, the tireless hum of steam and oil-powered machines echoed the drumbeat of relentless progress. Unprecedented population growth mirrored the rapid expansion of industry, as the escalating tempo of life danced to the melody of unbounded advancement. This was a defining moment in human history, the grand tableau of the Fourth Civilizational Revolution.

Following the echo of this industrial crescendo, there emerged a need for a robust financial infrastructure. A mechanism to channel the surging river of wealth and prosperity to power the engine of America's entrepreneurial spirit. Thus, the New York Stock Exchange (NYSE) was born.

2. The Birth of Wall Street: Wealth Redefined

Beneath the shade of a Buttonwood tree on the 17th day of May in 1792, a seminal agreement was inked by two dozen stockbrokers and merchants in New York City. The Buttonwood Agreement, as it came to be known, represented the birth of the NYSE. This influential financial behemoth was more than a market; it was the heartbeat of America's economic ambition. It synchronized the investment fervor that propelled industrial ingenuity, ensuring the continuous circulation of capital necessary to fuel the onward march of progress. In this nascent period, the affluent and entrepreneurs predominantly raised and dispersed their capital through personal communications and paper transactions. Inevitably, the slow, manual processes were riddled with latency, leading to significant flaws in the trading of stocks and commodities.

But, what is the essence of wealth? What does currency strive to signify?

"Money, therefore, the great wheel of circulation, the great instrument of commerce, like all other instruments of trade, though it makes a part, and a very valuable part, of the capital, makes no composed, in the course of their annual circulation, distribute to every man the revenue which properly belongs to him, they make themselves no part of that revenue."

Adam Smith, ‘Wealth of Nations’, on the information of money

Money serves as a symbolic representation of the distribution of tangible resources and knowledge throughout society. It acts as a mnemonic within the financial structure, indicating the allocation of assets, yet is susceptible to flaws and manipulation. True wealth, however, is the capacity to harness and channel resources towards the achievement of a specific goal, typically that of survival and proliferation.

Eric D. Beinhocker, in ‘The Origin of Wealth: Evolution, Complexity, and the Radical Remaking of Economics’, perceives wealth through the fundamental law of the Universe, Physics.

"The Second Law thus provides a basic constraint on all life: over time, energy inputs must be greater than energy expenditures. All organisms must make a thermodynamic 'profit' to survive and reproduce… Economic systems exist in the real physical world and, therefore, they must obey the same law of entropy as everything else in the universe does."

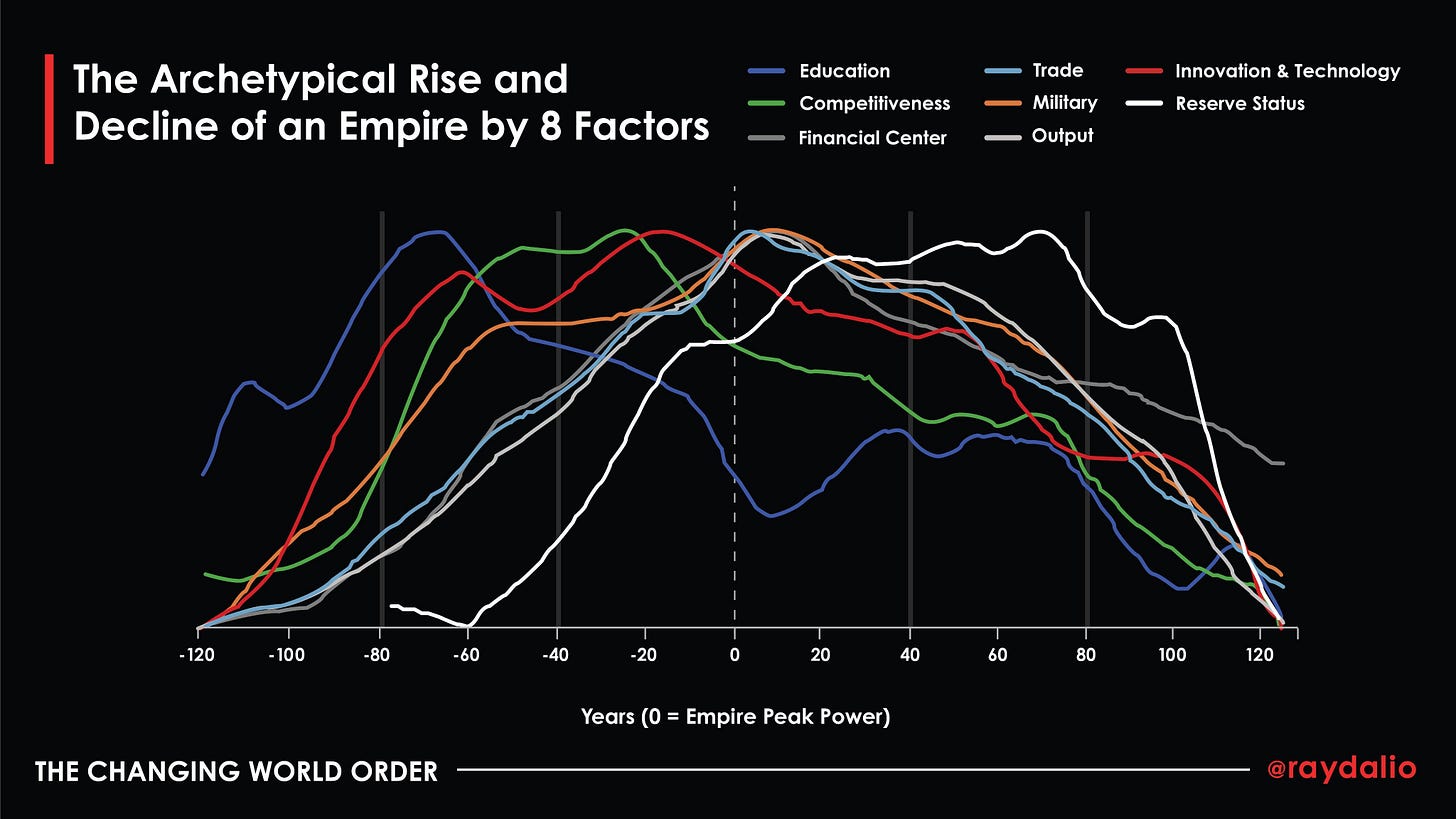

Ray Dalio, the renowned investor, from his book ‘The Changing World Order,’ has provided a nuanced framework for quantifying empirical power or "wealth", outlining eight distinct metrics in the accompanying graph.

While the definition of wealth may have morphed throughout history, one constant has remained: the use of data to track and analyze the distribution of resources. This practice, of using information to understand who possesses what wealth and what they're prepared to trade for it, has become integral to our global understanding of resource allocation.

3. When Machines Stumbled: Black Monday and the Impact of Latency

In the world of finance, where fortunes can be made or lost in a nanosecond, time is an unyielding master. This brutal reality was carved into history on October 19, 1987 — a day remembered with dread as "Black Monday".

Since the 1960s, computers had found their place on the stock exchange floor, becoming silent accomplices to an extraordinary escalation in trading volume, from barely a billion shares in 1960 to a dizzying three billion by the end of the decade. Yet, in the breathless rush of commerce, a latent villain lay in the shadowy crevices of the system, a ticking time bomb.

Latency, simply put, is the time interval between when a signal is dispatched and when it is received. It is dictated by the physicality of the boxes (the machinery), the logic (the software), and the lines (the fiber-optic cables) that transport (communicate) these signals (1’s and 0’s). No matter how far technology has advanced, the immutable laws of physics enforce a stringent cap on reducing latency. In the cutthroat arena of finance, where milliseconds separate winners from losers, latency was a slumbering leviathan.

Black Monday awakened this leviathan. Propelled by corporate buyouts and portfolio insurance, market prices had ascended to unsustainable heights. Inevitably, the bubble burst: panic selling swept across the market, magnified by computerized trading. The Dow Jones Industrial Average plunged by a shattering 23% within 24 hours. The latency, this lethargic lag in communication, amplified the hysteria. Traders, bereft of real-time data, were forced to make decisions on outdated information, exacerbating the frenzy.

Despite the advent of computerization, an overwhelming majority of trades during the crash were executed through snail-pace phone calls and human interactions. The ramifications of this reality were brutally exposed on Black Monday.

In the wake of Black Monday, the NYSE implemented almost 30 revisions, meticulously crafted to curb price volatility, enhance procedures, and fortify the resilience of NYSE electronic systems to sustain prolonged periods of heavy trading. The spotlight was firmly cast on one paramount objective: reducing system latency and increasing information exchange, which had so catastrophically fueled the chaos of Black Monday.

The pandemonium of Black Monday also uncovered another weak link: the rupture of markets and index arbitrage. Under normal circumstances, the stock market and its main derivatives — futures and options — function as an integrated whole. However, on Black Monday, this cohesion fractured, leading to pricing distortions and an increased sense of disarray and panic.

These events served as a stark wake-up call, reminding us of the critical importance of real-time data in finance and world communication. The latency, the stale information, the turmoil, the confusion — all these pointed towards an urgent need for a leap forward in communication technology and infrastructure. Financial institutions were incentivized to invest in superior, faster systems that would enable rapid data transmission, minimize latency, and introduce circuit breakers to prevent High-Frequency Trading (HFT) from overwhelming the market and triggering a crash.

Black Monday was a defining moment, a painful but necessary lesson that sparked the dawn of a new era in data exchange technology. The ashes of the crisis, coupled with the advent of the World Wide Web, catalyzed the development of high-bandwidth, low-latency, and increasingly intelligent data exchange technologies, heralding the beginning of the Third Industrial Revolution.

Part II: The Data Gold Rush

4. The Advent of Information Highway

The advent of high-speed internet, coupled with the explosive growth of technology, has catapulted data to the top of most desired resources. Today, tech behemoths and financial titans mine data with an insatiable thirst, mirroring the transformative fervor of the First and Second Industrial Revolutions. This relentless pursuit has stimulated significant investment in and integration of advanced broadband internet systems and formidable computing power. A testament to the rate at which our world is being shaped and governed by the might of data.

To bridge this historical pivot, we turn our attention to one of the revolutionary advancements in technology that made this data boom possible — fiber optics. The marvel of modern fiber optics can be traced back to one man, Narinder Singh Kapany. As a young physicist, Kapany challenged the conventional wisdom of his professors who staunchly proclaimed that light always travels in a straight line. His quest to explore the behaviors of light paved the path to the invention of fiber optics — a technology that allows the transmission of light through thin tubes of glass.

Yet, harnessing fiber optics for communication required a significant reduction in the cable’s attenuation rate — a reduction in the strength of a signal. Throughout the 1960s and 70s, technological advancements led to a dramatic decrease in the number of impurities in fiber optic cables, enabling light (data) to travel great distances dramatically decreasing the loss of information and intensity.

By the mid-1980s, long-distance fiber optic cables had evolved from theoretical aspirations to practical realities. This trajectory of progress reached new heights between 2016 and 2020, during which over 100 new cables were laid across the globe — a herculean effort valued at an estimated $14 billion. These massive investments fueled the data age, underpinning our swift transition into a world dominated by the power of data.

Source: https://www.visualcapitalist.com/wired-world-35-years-of-submarine-cables-in-one-map/

In harmonizing advanced long-range fiber optics with other cutting-edge communication technologies, we've witnessed an extraordinary surge in data exchange capacity and elevated transmission velocities. These advancements have seamlessly woven together to ignite the profound and far-reaching data revolution, shaping the contemporary digital landscape.

5. The Battery and Processor for Data

Our collective digital endeavors have birthed an intricate web of information — an ephemeral monument resembling our silicon-carved Tower of Babel. This infinite virtual marketplace, buzzing with everything from stock movements to cultural memes, effectively crystallizing our humanity into a pixelated prism, a treasure trove poised to power up Humanity, like a Super Mario mushroom.

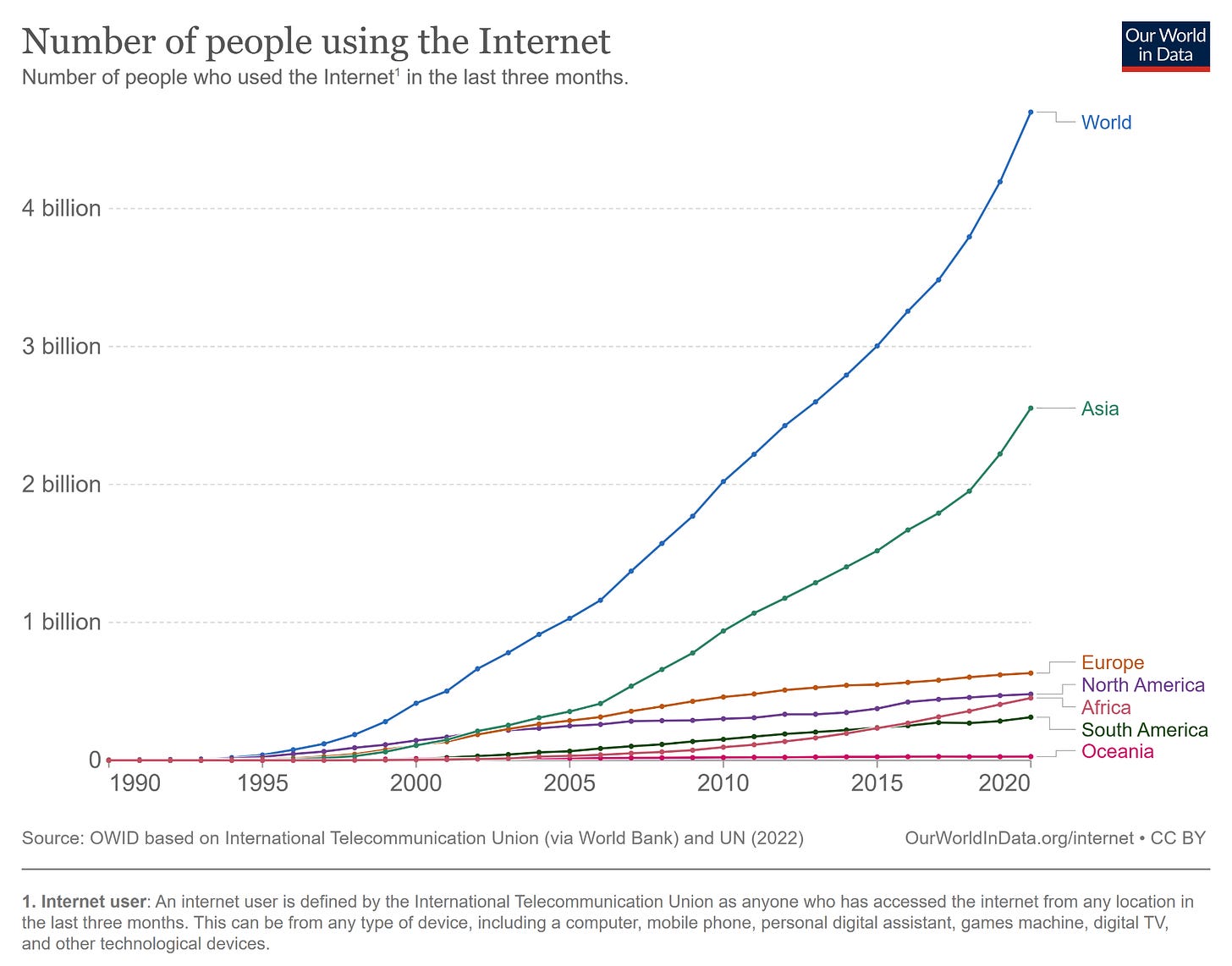

The scale of human engagement with the internet is staggering — a spider web of interactions that continues to bewilder but empower us. This data — this digital goldmine — is being meticulously mined by corporations, governments, and financial institutions such as the NYSE. The objective is to illuminate the intricate workings of Human nature, wealth distribution, and perhaps even the fundamental understanding of the Universe itself.

The allure of this data-magnet has precipitated an unprecedented influx of resources, metamorphosing grains of sand into sophisticated computer chips. The quest is to drive the cost of computation to its absolute minimum, thereby maximizing our capacity to gather, store, and analyze data.

The more data we have at our fingertips, the more refined our understanding of the Universe becomes, enabling us to allocate resources more efficiently for the betterment of Humanity. This zealous quest for knowledge acts as a centrifugal force propelling us towards the echelons of a Kardashev Type I civilization — an Earth society.

The internet, our greatest technological marvel, has sown the fertile seeds of this forthcoming epoch, a bountiful orchard of knowledge that is yet to be entirely harvested. But before we can reap this digital bounty, we need to construct a potent energy source — a digital dynamo — capable of sustaining our data-driven machinery, equipping us for our celestial odyssey in this cosmic amphitheater.

Part III: The Advent New Renaissance

6. Framing the Sustainable Economy

In our digital quest, let us momentarily detour and glance back at the past. In The Hitchhiker’s Handbook I, we embarked on a panoramic journey across the expanse of the four previous technological epochs: the Foraging, Horticultural, Agrarian, and Industrial revolutions. Each of these epochs had left indelible imprints on our Human civilization, transforming our culture and influencing our existence in profound ways and allowing us more free time.

As we steer our gaze back towards the unfolding present, we find ourselves on the precipice of an epochal shift — the Fifth Revolution. Emerging contours are beginning to outline an era underscored by the tenets of sustainable energy, artificial and automated intelligence, and the nascent but promising space economy. Echoing the insights of social theorist Jeremy Rifkin, we discern a paradigm shift that increasingly gravitates towards renewable energy and digital technology. This impending era can be demarcated by his five distinct pillars:

Shifting to renewable energy

Transforming the building stock of every continent into micro-power plants to collect renewable energies on site

Deploying hydrogen and electric storage technologies throughout the infrastructure to store intermittent energies

Using IT to transform the power grid into an energy-sharing intergrid sharing energy and information more efficiently

Transition the transport fleet to electric plug-in and fuel cell vehicles that can buy and sell electricity on a smart, continental, interactive power grid

7. Navigating Tesla's Master Plan: Charting the Course for a Sustainable Energy Future & Economy

Tesla stands at the forefront of this transformative wave, shaping the blueprint for our sustainable future. Their ambitious Master Plan articulates six fundamental pillars underpinning this nascent era of energy:

Retrofitting the existing grid with renewables

Transitioning to electric vehicles

Adopting heat pumps in residential, business, and industrial sectors

Electrifying high-temperature heat delivery and hydrogen production

Powering planes & boats sustainably

Manufacturing the Infrastructure of the Sustainable Energy Economy

Note: Analyzing data provided by the Energy Information Administration (EIA) from 2019-2022, Tesla has extrapolated the requirements to cater to a sustainable global economy. It's essential to note that this analysis focused on the U.S. due to the availability of high-fidelity hourly data and then scaled to estimate global needs, which is admittedly a simplification, as global energy demands differ significantly from the U.S. in their composition and are expected to increase over time.

The company has made careful estimations regarding land requirements for a global sustainable energy economy.

But why, you may ask, should WE funnel our wealth into this fledgling, unproven economy?

The answer is as alluring as it is straightforward. It's not just the prospect of an alternative to the environmental hazards of fossil fuels that makes the sustainable energy economy so appealing. No, the answer also lies in the promise of economic viability, a fiscal renaissance fueled by sustainable energy. In the long run, it promises a 40% reduction in investment costs for the next 20 years compared to fossil fuels.

Imagine vehicles, no longer tethered to the finite resource of oil, cruising our roads with an efficiency four times greater than their gas-guzzling ancestors decreasing the cost of transportation. Envision homes and industries warmed by heat pumps offering more than double the efficiency of traditional gas furnaces, decreasing the costs of our homes.

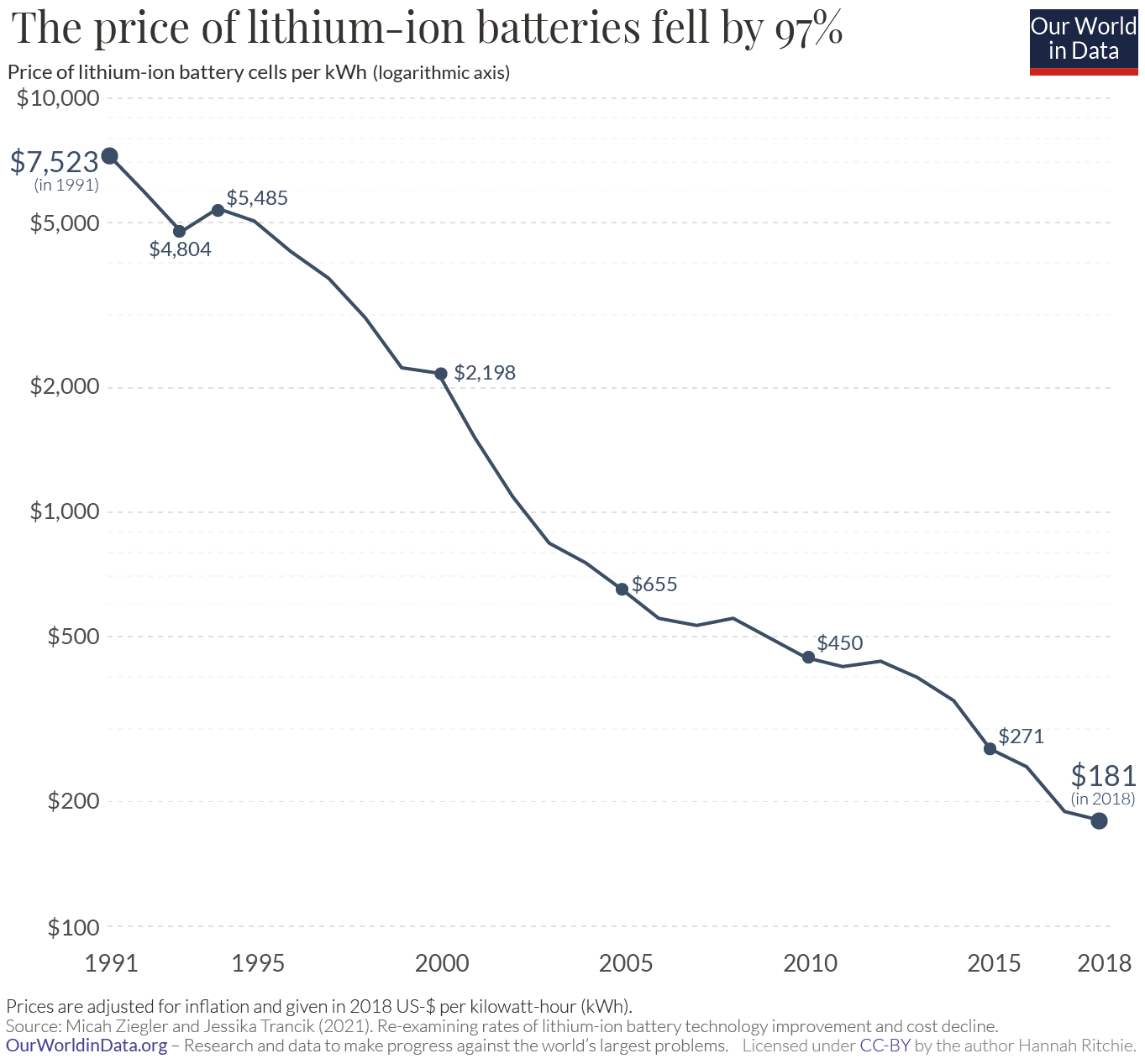

The cost of sustainable energy production and storage has hit an inflection point where it is becoming less affordable to use fossil fuels in comparison to other sustainable energy sources. This is a true push to force change into our new energy economy creating a more equitable, affordable, and abundant life than we have ever experienced.

And what powers this revolution, this paradigm shift in energy? The most abundant nuclear reactor in our solar system: our very own star, the Sun. It's a world ripe with possibility, promising not just a healthier planet with less waste but also an economically thriving one for Humanity.

8. Tesla’s Energy Software - An Autonomous Energy Market

Imagine holding sunlight in your hands. Well, not quite — but Tesla is trying to do something close. Their mission? Capturing the boundless energy of the Sun and bottling it up for when we need it most, fueling the ceaseless heartbeat of our data-centric era. The instrument for this endeavor is none other than Tesla's Megapack — the largest lithium-ion batteries, currently unmatched in their capacity.

A product of 16 years in battery development, Tesla has sown the seeds of this future energy economy across the globe. With their energy storage systems established in over 65 countries, they have laid the groundwork for a new era in energy management.

But, it's not enough to have power. You need to wield it intelligibly — a challenge Tesla meets head-on with Autobidder, their innovative energy strategy software. This sophisticated system manages complex co-optimization, enabling the full potential of these large storage systems to be tapped. Like the NYSE, it simultaneously balances various value streams by bidding energy prices in real-time in the network, sharing energy where it is needed when it is required.

In an electrified harmony, this “alive” energy exchange pulsates at the heart of our developing energy marketplace. It's an embodiment of an epochal shift, one that sees our civilization shaping around artificial and autonomous intelligence. The rhythm of this transformation resounds in every spark of electricity we trade, and every whisper of data we exchange, igniting the dawn of an exciting new era in Human ingenuity.

Part IV: The Future of Economics

9. The All-Seeing Eye: BlackRock’s Aladdin

Pulsing beneath the steel and glass facades of Wall Street, there runs an artificial intelligence of nearly mythical stature, AI genie — Aladdin.

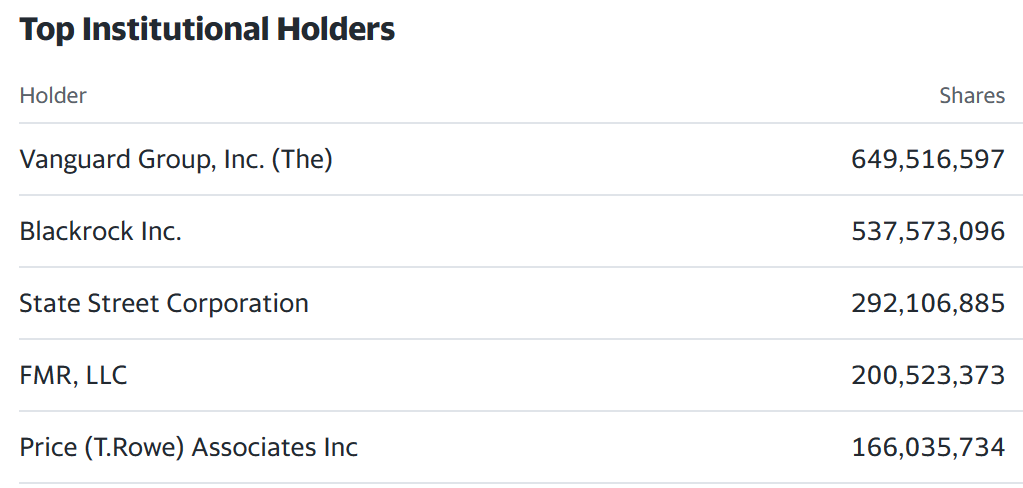

Short for Asset Liability and Debt and Derivative Investment Network, this prodigious creation of BlackRock now wields control over more than $14 trillion in assets, equating to about 7% of the world's total wealth (these values are meant for scale only and may vary), while dutifully monitoring approximately 30,000 investment portfolios (see Appendix for more information). A silent and unseen sentinel, Aladdin is progressively reshaping the contours of the global economy, wielding its power with subtlety and expanse.1234

However, Aladdin is far more than a tool. It's a window into the very future of finance. It's a mystical entity that's been conjured by BlackRock to offer them the ability to peer into the future, a genie granting wishes with its advanced predictive capabilities. By facilitating risk transparency and efficient trade modeling, it does more than streamline workflows. Aladdin is a trailblazer, charting a path towards a new paradigm of intelligent portfolio management — a single, all-encompassing enterprise platform that far surpasses its piecemeal predecessors.

Fueled by BlackRock's team of mathematicians, physicists, and engineers, Aladdin's artificial intellect has grown and evolved, steadily consuming an ever-diversifying diet of data. Reflecting the same shift towards sustainability that Tesla has helped catalyze, Aladdin recently incorporated sustainability index scores and ESG data into its vast data repertoire. Its creators have looked into the crystal ball and glimpsed a future where sustainable energy economics isn't merely desirable, but inevitable and lucrative.

As AI gains our trust, especially in the economic system, there is a risk of relying too heavily on technology and forgoing holistic qualitative judgment. Aladdin's complexity, while its strength, is also its potential downfall. Its intricate inner workings, often referred to as a “black box,” can develop biases over time, only revealing themselves in times of crisis. This could lead to investor losses and even a potential market dysfunction, disconnecting markets from reality and leading to speculation and crises. There must always be Humans in the loop to ensure these models are used as stewards supporting Humanity’s prosperity.

Yet, as we contemplate what lies ahead, one fact is abundantly clear: Aladdin stomps forward with power. It is inexorably reshaping the global economy, Wall Street, and the very nature of automated intelligence. The genie of AI is out, and there is no returning it to the bottle. There will be ever more powerful AIs, hungry for data of all kinds — financial, health, psychological, sociological — much like a Cookie Monster of the digital age.

In these winds of change, there still linger echoes of the past and an insatiable hunger for ever more comprehensive and timely data. These twin drivers of innovation propel us ever forward, even reaching toward the stars in our quest for intelligence.

10. Space: The New Frontier for Economic Data Exchange

SpaceX is designing an intelligence not entrenched in the depths of the ocean, but lofted among the stars. Named Starlink, this constellation of satellites holds the potential to reframe the world of information exchange and digital asset trading on a global scale, pushing the boundaries of long-range communication, even while acknowledging some limitations over shorter distances.

Worth watching until the end.

Historically, inter-regional data transfer has been tied to land, rooted in a network of microwave towers that connected bustling trade centers like London with Frankfurt, or New York with Chicago. Yet, like grains of sand slipping through an hourglass, the benefits of latency gains increased with distance; the further the microwaves had to travel, the more limitations of this technology were illuminated. In this context, establishing a microwave link between New York and London, or, even more ambitiously, between London/New York and the burgeoning Asian markets, did not translate to reality.

Stepping into this gap is SpaceX's ambitious Starlink, each capable of both uploading and downloading data with receivers on Earth, while also adept at relaying signals between their celestial brethren.

Source: Live Starlink Satellite and Coverage Map

As they cast our gaze skyward for solutions, physics, the immutable sentinel of the Universe, offers an essential reminder. Imagine a direct fiber connection from NYC to London, a stretch of 5,577 km (3,465 miles) assuming an Earth radius of 6,378 km. This span, by the very laws of physics, could not offer a round-trip latency lower than 55 milliseconds due to the refraction index of light within fiber optics, slowing it by approximately 40% compared to the vacuum of space.

In contrast, a low Earth orbit (LEO) satellite constellation hovering at an altitude of 550 km could theoretically outstrip fiber optics by 12 milliseconds in round-trip propagation latency. This estimate excludes possible complications such as jitter (from moving satellites) and processing delays from active equipment (like the modulation and demodulation of signals). Nevertheless, it paints an exciting picture of the future. If the satellite network can be finetuned for cut-through mode across inter-satellite links (ISLs), any delay caused by endpoint modems could become virtually insignificant.

Space, once the final frontier, now becomes a promising platform for the seamless, global transmission of information and currency. The potential of Starlink is as vast and unbounded as the cosmos it resides in — a future where the exchange of data could power the new energy economy.

11. Conclusion: Humanity's Voyage to a Type I Kardashev Civilization

Each revolution in our history has seen humanity reach ever farther, exploit novel resources, and apply groundbreaking technologies to craft a world hopefully better than we found. This new revolution is heralded by technology and sustainability, and fueled by the unbounded promise of AI and data to drive to a better future. Our odyssey is far from its conclusion.

In this grand narrative, we glimpse the early stages of humanity's transition towards a Type I civilization on the Kardashev scale — a civilization capable of harnessing and controlling the energy of an entire planet. As we embark on this journey of astronomical proportions, we have the opportunity to transcend our current confines and usher in a new future more informed than the combination of our past lives. Let us harness the power of the infinite data at our fingertips, using it to illuminate the truth of our present world.

Instead of being swept along by unseen forces, let us strive for a future crafted by our shared desires and guided by our collective wisdom. We need not be passive passengers, but rather, conscious navigators charting the course of our own destiny.

“To be on a quest is nothing more or less than to become an asker of questions.”

Sam Keen

Appendix

All data from Yahoo finance

Top 10 S&P 500 Companies - BlackRock’s Influence

Apple

Microsoft

Amazon

Nvidia

Alphabet (Google)

Meta (Facebook)

Tesla

Unitedhealth Group

BlackRock